Until 2-3 years ago, only music that was published under the control of major record labels could access global digital music channels such as iTunes, Amazon, Spotify and others. The rest of the market, almost 70 %, was not sufficiently represented in digital sales channels, while this is the the music with the largest growth potential in the music market, outpacing by far outpace the physical sale of music media in the near future.

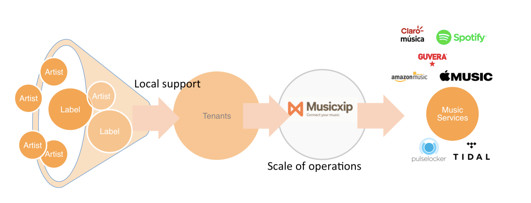

La Cupula Music has solved this problem by creating a SaaS platform denominated Musicxip , which operates as a very advanced aggregator serving as an intermediary and managing the relationship between independent labels and artists, and large digital music channels (the most known being Spotify , iTunes , Amazon or YouTube).

La Cupula Music simplifies the process of managing, distributing and promoting music content in the digital ecosystem. Clients can manage their entire online music business through a with label Platform “Musicxip”.

Music companies, or ¨Tenants¨ buy the Musicxip white label platform and offer Digital Distribution, Royalty reporting and complementary services to their artists and labels. The Musicxip platform is contracted on a SaaS basis.

The company exploits a 4.0, fully digital business model. All services are offered online and the relationship with customers is through digital tools, counting in many cases with customer participation in the co - creation of content. It is a model that works all year round, 24/7, from anywhere in the world and is multilingual. Clients just need an Internet connection and a smartphone, tablet or computer.

We also offer them premium, complimentary services such as real time analytics, video marketing, online mastering, rights management, CD/Vinyl manufacturing, Merchandise, licensing and promotion. The complementary services are contracted on a pay-as-you-go basis from La Cupula Music as well. These services are provided by La Cupula Music under the Tenant´s brand.

E50% of the total revenues of the music industry already come from digital sales. The expected annual growth of digital music will exceed 25 % over the next 4-5 years.

The volume of the global digital music market in 2015 was 6,900 million. It is estimated that by 2020 these figures reach up to 17,000 million. In this market , the share of digital distribution and services where La Cupula Music is active, will amount to 10-15% .

Globally there are 8 competing platforms . The most important are The Orchard, Consolidated independent, Revelator, Fuga, y Royaltyshare.

TRACTION

Musicxip is already being marketed, having achieved, among others, the following milestones:

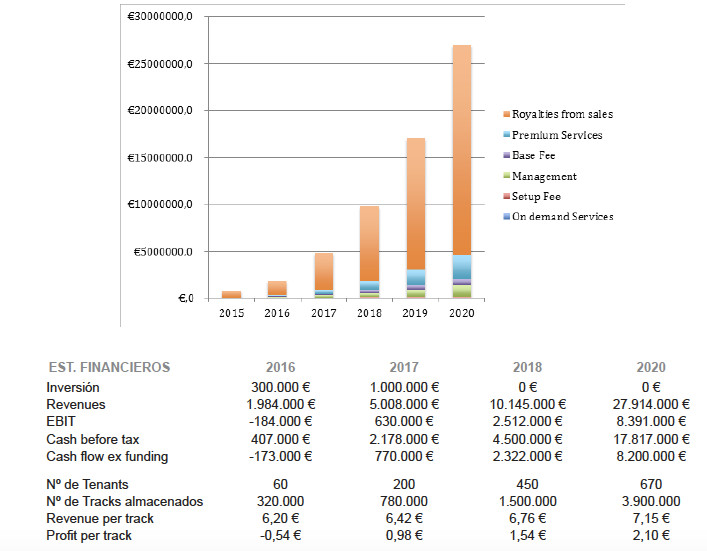

• Turnover 1M€ in 2015, heading towards 2M€ in 2016.

• More than 30,000 active customers in 13 countries, who have already placed their albums in their favourite online music channels using our tools.

• Contract signed with more than 30 online music channels (Spotify, iTunes, Deezer, Amazon Music, Google Play, Shazam, Tidal, YouTube or Gracenote Music among others) our software is approved by these channels for sending the content fully automatic. At present an album of an artist is automatically made available in most online channels in less than 5 days.

• Technology supported by a software of which the code is protected by copyright.

• Platform in 8 languages.

• The platform can incorporate other services relevant to the music business such as:

o Physical distribution.

o CDs and Vinyl manufacturing.

o Collection of mechanical rights and and synchronisation rights.

o Digital promotional tools for artists.

o Exploiting video channels (YouTube, Vimeo ...).

o Promotion in social networks.

1) B2B: The sale of Musicxip as a B2B SaaS platform to Tenants:

The company generates it´s main revenues through:

• Royalties from sales generated through sales of content in DMS; take into account however that almost all royalties are paid out to the Tenants.

• Setup Fees; charged for implementing a tenant (one time fee).

• On-demand services (Distribution, updates, takedowns in the online stores).

• Management (recurring revenues paid by tenants for maintaining content on the platform).

• Base Fee (recurring revenues paid each month by tenants to have access to the platform).

• Premium services such as 3rd party integrations, promotion services, manufacturing etc.

• Other revenue streams (which are existent but not taken into account in the financial planning as these are of minor importance and do not form part of the basic business model).

• Revenue share from services generated through third parties.

• Referral fees generated though links to content that are created by our crawler.

2) B2C: Complementary services offering to Tenant clients:

These services are the B2C component of the business model. They are priced on a mark-up basis or on a revenue share basis, depending on each service, for example:

• Real time analytics: Fee/month/user. We charge the tenant, the tenant charges the end user.

• Video marketing: Revenue share. We get a percentage of the money made by each video from our Multi Channel Network.

• Online mastering: Revenue share. We get a percentage of the money made through the integrated Online Mastering module.

• Rights management: Revenue share. We get a percentage of the money made through the integrated licensing service module.

• CD/Vinyl manufacturing: Revenue share. We get a percentage of each manufacturing order that is processed through the platform.

• Promotional services: Fee/month/user. We charge the tenant, the tenant charges the end user.

CASH FLOW

In the current capital structure, the founding partners control 88 % of the shares. The corporate structure is as follows:

- Maarten van Wijck (CEO - 34.81 %): expert in the development of digital models for the music industry.

- José Luis Zagazeta (CFO - 34,81%): with extensive experience in the music industry.

- Pedro Arnal Puente (CTO - 20%): expert in architecture and engineering development of IT structures.

In total 20 people involved in innovation, technology and business development make up the La Cupula Music Team.

Investment proposal

Investment proposal summary:

Since the foundation in 2007 and with just one round of investment of € 65,000 in 2009, our company has been able to evolve the business to +1M euros in sales in 2015, generated from a diverse range of channels and services. Business development has been continuous with investments from value generation and and sales results.

Now is a crucial and very timely moment to be able to capture a significant market share- so it is necessary to accelerate growth and technological development. We are looking for an investment of 300,000 euros, in exchange for a 10% stake in the company capital.

Reasons to invest:

• Duplication of revenue every year since 2012.

• La Cupula Music is well established as a brand in the Spanish and Latin American markets.

• Unique B2B2C model.

• Servicing 30,000 artists from around the world through Musicxip Tenants and La Cupula Music.

• Musicxip is the core business of more than 30 companies worldwide offering digital music distribution services.

• Direct contract and and supply of content to more 30 leading digital music channels including Spotify, Tidal, Deezer, Shazam, YouTube and Apple Music.

• Management with experience and know-how of over than 15 years in Digital Music and software development.

Investment will be used for:

• Additional development staff (60%).

• Marketing and Sales (40%).

Investment objectives:

• Achieve 60 tenants at the end of the year.

• Increase our presence in 20 countries through inbound marketing strategy.

Milestones to be reached with the funds obtained:

• Development Goals: API, detailed analytical royalties, AutomaticQuality Control, scalable backoffice for Tenants, promotional tools in social media.

• Prepare the company for the next round of investment with the goal of further developing Musicxip, invest in collaborations/key partners and expanding service offerings.

EXIT

The exit plan is to sell the company to a direct competitor or a great “ player” in the music market, interested in acquiring technology platform and direct connection with online music channels, in addition to the international catalog of artists and labels.

Mobile Phone providers, Internet Services providers, Aggregators and major labels can be possible acquisition partners.